By Parkdean Resorts on 25/10/2021

2020 was a rocky year for the travel industry, and 2021 was set to be the saving grace for Brits desperate to get away, with holiday companies waiting with open arms. Due to the ongoing changes in the holiday industry last year, as the UK’s largest holiday park operator, here at Parkdean Resorts, we have conducted extensive research into the staycation market, to discover exactly how the Covid-19 pandemic had affected it.

This year, we wanted to conduct this same research again to find out how the travel industry has adapted to the new ways of travelling, and the impact this has had on the sector as a whole. So, we surveyed 2,500 people across the UK and analysed our own booking and search volume data.

A quarter of Brits are still planning to travel in 2021 and 2022

In last year’s research, we found that 20% of people surveyed had cancelled holiday plans altogether, however this year, our survey found that 24% said that they would continue their arranged travel in 2021 and 2022 - despite the threat of Covid-19. Last year, 35% of the people surveyed said they were delaying booking any holidays until the pandemic was under control, but in comparison this year, 30% of those surveyed did not and do not have any further plans to travel in 2021 or 2022, suggesting that now that the Government guidance allows it, there are more people planning to travel.

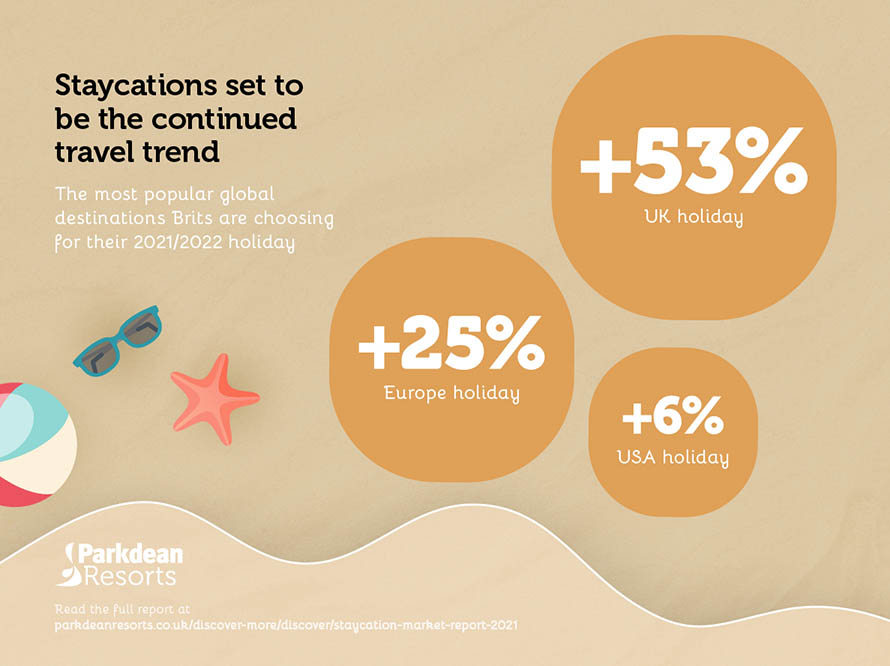

More generally speaking, of those interviewed, 39% said they would be more inclined to holiday in the UK after the pandemic, and just slightly less at 33% said they would prefer to holiday abroad, showing how opinions are now split - but both holiday options are still tempting Brits to travel as the survey also found that the majority at 53% intended to holiday in the UK in 2021 and 2022.

Good reviews overtaken by cancellation policies as the most important factor when choosing a holiday company to book with

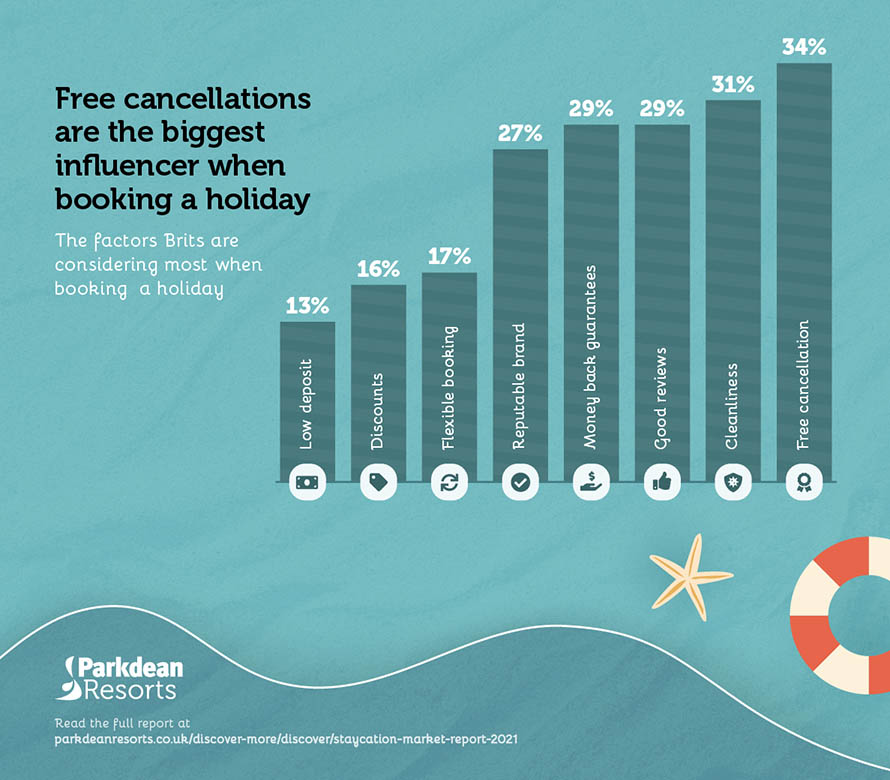

Alongside this, our research last year found that 45% of those surveyed said that good reviews were the biggest contributing factor for choosing a holiday company to book with post Covid-19. But this year, the most popular choice, at 34% was free cancellation options as the most influencing factor, and only 29% chose good reviews.

This shows that people are still wary of changing restrictions and laws, meaning that having the option of being able to cancel their holiday and be refunded at the last minute is increasingly important when choosing a holiday company to book with.

42% of Brits look for overall value for money when choosing their type of holiday

42% of those surveyed said that overall value for money was the most important factor for choosing a holiday destination or type of holiday. Our research also shows how holiday spending habits have changed over the last 12 months. Last year, our survey found that, on average, Brits were looking to spend £868.55 on their staycations after Covid-19, which was a -24% decrease compared to before the pandemic. Interestingly, our survey this year found that Brits were looking to spend just a little less, averaging £855.35. Although this figure has not significantly decreased, it shows that the pandemic has affected the way Brits choose to spend their hard-earned cash, and value for money and holiday offers is something that is at the forefront of Brits minds.

Online searches for staycations are still on the rise

Our research also investigated how the pandemic has affected online searches for holiday terms. Interestingly, ‘travel UK’ has experienced an 83% increase in searches between June 2020 and June 2021. Similarly, our research last year found that searches for ‘travel UK’ were up by a staggering 103% between March 2019 and March 2020. This shows that the demand for staycations was at its highest between 2019 and 2020 as UK breaks offered the most feasible and reliable holiday option, but the trend has continued to stay as searches in 2020 and 2021 were still considerably high, even as international travel began to open up again.

Similarly, online searches for ‘UK city breaks’ were up 311% between June 2020 and June 2021, and ‘UK family holidays’ were up 235% between June 2020 and June 2021, also highlighting how people are keen to get back out there, and that staycations are still in demand.

The most in-demand staycation spots for 2021 and 2022

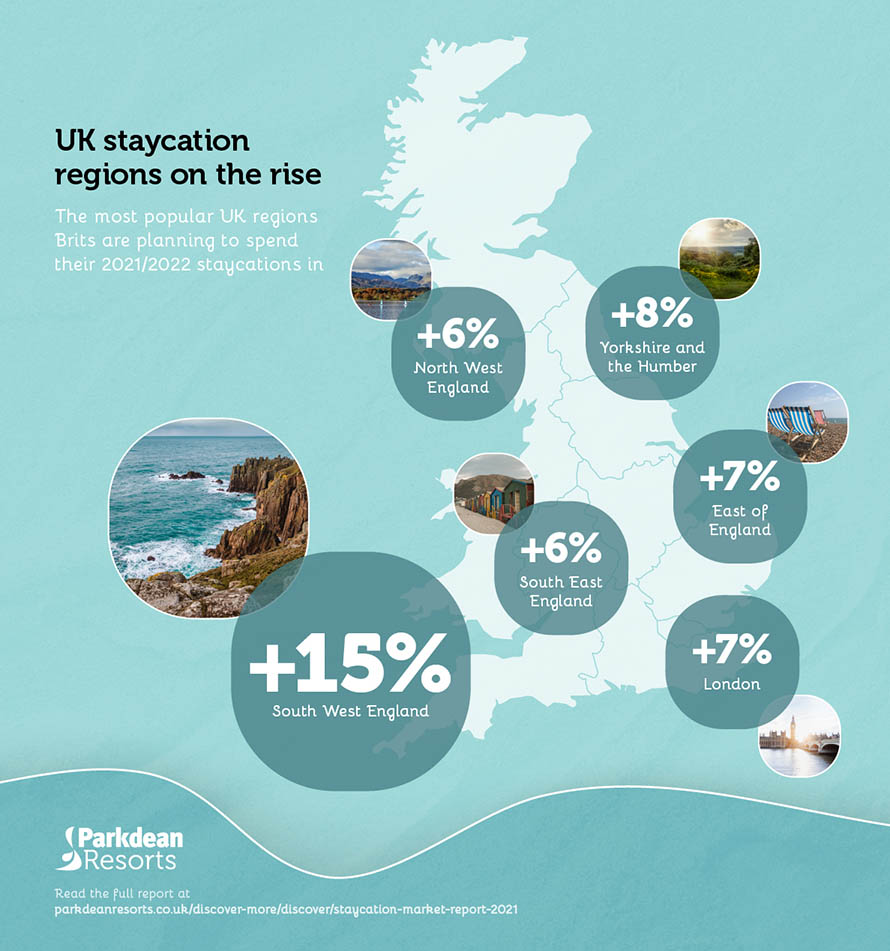

So for those choosing to explore what the UK has to offer, where is the most popular place to staycation?

The survey revealed that 15% of those choosing to stay in the UK for their holidays in 2021 and 2022 would choose to stay in the South West of England, in a location such as Cornwall. This is also backed by our own data, showing that searches in 2021 for 2022 holidays to Cornwall are up by 66% year on year. Not only that, but our internal data shows that July 2022 is set to be the busiest month for staycations, as 23% of holiday searches came under that month.

According to the survey data, the next most in-demand staycation spot for 2021 and 2022 is Yorkshire and The Humber, with 8% of people surveyed choosing to staycation there. But our own data shows that Lancashire is the next most in-demand staycation spot, as searches for 2022 holidays in 2021 were up 60% year on year and experienced the second-highest increase. Not only that, but searches for 2022 holidays to the Lake District, Yorkshire and Wales have also all experienced significant increases with an average of 56%.

Our research last year found that Cornwall and Devon were the top staycation spots for 2020, but it looks as though Devon has lost its title to more northern destinations such as Yorkshire and Lancashire.

But although the places people plan to travel to have slightly changed, what about who people want to travel with? Our research last year showed that the majority of those surveyed, at 61%, wanted to travel with their significant other, such as a husband, wife or partner. Our survey this year found that this theme has stayed relatively the same, with 64% of those surveyed choosing to holiday with their better halves.

We previously mentioned that Brits are now looking to spend slightly less on their staycations in 2021 and 2022, averaging at around £855.35, but where in the UK is spending the most on their holidays? According to our survey data, those in the North East of England were looking to spend the most on their holidays whether that be in the UK or abroad, with an average of £1,501, and those in the West Midlands were looking to spend the least, averaging at £944 on their holidays in 2021 and 2022.

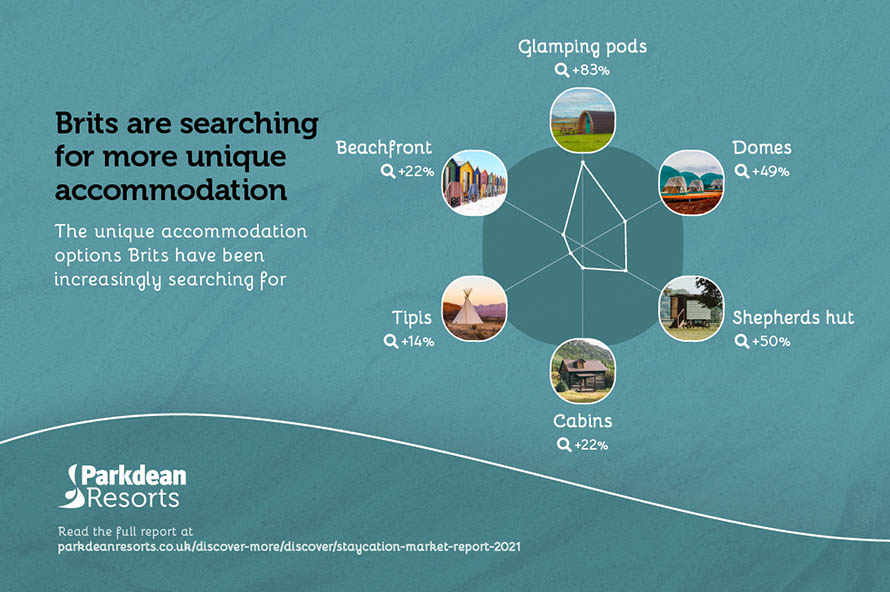

So, we’ve discovered where Brits want to stay and how much they’re willing to spend, but what exactly will they be staying in? We analysed the number of online searches for unique accommodations, and coming in on top is ‘glamping pods’, with an 83% increase in searches between May 2020 and May 2021. The second most popular form of unique accommodation in the UK is ‘shepherd huts’, with a 50% increase in searches between May 2020 and May 2021. Similarly, ‘domes’ experienced a 49% increase, and ‘cabins’ a 22% increase.

How have major travel brands faired since the lifting of travel restrictions?

Our research also discovered how Covid-19 has impacted brands across the travel industry. We analysed online searches for popular travel companies between May 2020 and May 2021.

| Search term | % Increase |

|---|---|

| Air BnB | 50% |

| Expedia | 22% |

| TUI | -33% |

| On the Beach | -33% |

| Last Minute | 49% |

| TripAdvisor | 809% |

| Travelsupermarket | 50% |

| Ice Lolly | -45% |

| Money Saving Expert | -33% |

By comparing this to last year’s analysis of searches between March 2019 and March 2020, we saw that TripAdvisor had experienced a -55% decrease in searches, but our research this year shows an impressive 809% increase. As a reviews platform, this shows that Brits are keen to research before experiencing new adventures, whether that be near or far.

However, by analysing the number of online searches for abroad holiday terms between May 2020 and May 2021, we can see that across the board, these searches are still experiencing significant decreases. For example, searches for ‘Package holidays’ have experienced a -33% decrease, similarly with searches for ‘cheap holidays to Spain’, which decreased by -64%, and ‘last minute holidays’, which decreased by -45%. This shows that although travel restrictions have been lifted, there is still significantly less demand for holidays abroad, and this could be because of uncertainty regarding travel as the Government’s traffic light system continues to change.

Our expert opinion

Catherine Lynn, Chief Customer Officer, Parkdean Resorts said:

“We’re always fully booked for the holiday season, and this year has been no different. Demand has definitely increased, and we see the UK’s appetite for staycations remaining high, even as international travel opens up again. Bookings have remained strong throughout September and October, and we’re looking forward to another busy year in 2022.”

If you're looking to make the most of what Britain has to offer, explore our staycations to discover just the holiday you need after a stressful few years.

Methodology

Survey commissioned in July 2021, to a nat rep audience of 2,500 UK adults on their holiday intentions.

In 2020 we ran a covid travel report which looked at how the pandemic affected the staycation market in the UK. Re-running the campaign in 2021, we looked into the behavioural changes in people with many unable to travel internationally for over a year and a half. The report is a combination of internal data, open-source data, search volumes, and survey data.

References